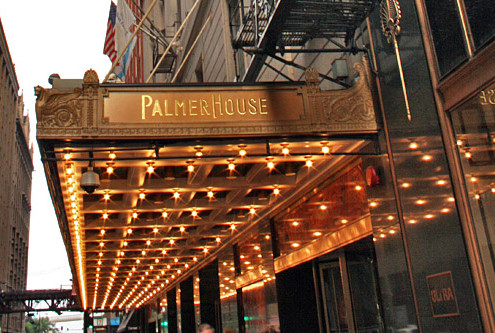

Case Study | Palmer House Hilton

- Market Analysis and Forecast

- Creation of 10-Year Capital Plan

- Hold vs. Sell Analysis

- Disposition to maximize sale proceeds and fee income value

SITUATION

The Palmer House Hilton is an iconic, historical hotel comprised of 1,690,000 gross square feet situated on a 1.8 acre site that encompasses over two-thirds of a city block. The 23-story 1,639-room property contains a total of 1,475,000 above-grade space including 127,000 square feet of meeting space, 57,000 square feet of retail, five food and beverage outlets, and an adjacent 48,800 square foot office building.

As part of its asset light strategy, Hilton Hotels Corporation was contemplating the merits of a Hold vs. Sell strategy, and a path to yielding the highest return on invested capital and related impact on earnings per share

PLAN

- Conducted a detailed market analysis to determine short and long term positioning and performance potential of the asset

- Studied the existing facilities program relative to then current demand drivers, and projected programming changes required to meet the evolving demand trends in the market

- Conducted a comprehensive physical condition assessment including an MEP study, building infrastructure and central plant analysis, brand standards compliance gap, and IT needs assessment,

- Created a 10-year capital plan across three scenarios: “Baseline”, “Competitive Positioning”, and “Repositioning” including ROI projects; and provided related supporting financial analysis including impact to Earning per Share for each scenario

- Conducted a Hold vs. Sell Analysis that incorporated detailed results of the market study, physical condition assessment and capital plans

- Recommended the sale of the asset encumbered by brand and management

RESULTS

- The asset was sold at a price of $240 million at a TTM cap rate of 5.5%, and an EBITDA multiple of 14.2X

- Asset was encumbered by brand and management delivering fee income Net Present Value of $66 million

Disposition Cap Rate

5.5%